In 2025, many businesses and individuals are wondering about the fate of the tax cuts implemented by the Tax Cuts and Jobs Act (TCJA) of 2017. Elder Hanson & Company, Ltd.’s Naperville, IL, tax planning professionals are here to help you navigate these impending changes and prepare your business for what lies ahead. Understanding when the Trump tax cuts expire and what tax cuts expire in 2025 is crucial for effective financial planning.

When Do the Trump Tax Cuts Expire?

The majority of the individual and some business-related provisions of the TCJA are set to expire at the end of 2025. This means that without congressional action, many of the tax benefits currently enjoyed by businesses and individuals will revert to pre-2018 levels starting January 1, 2026.

Key Tax Provisions Set to Expire: What Business Taxpayers Need to Know

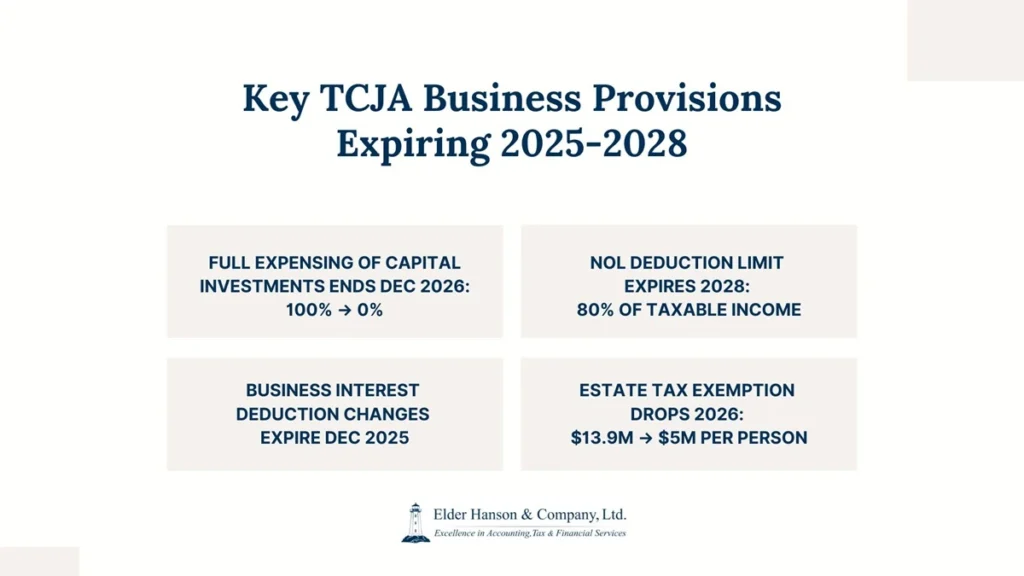

One major provision set to expire is the full expensing of short-lived capital investments. This allowed businesses to deduct a certain percentage of the cost of certain assets like equipment and machinery in the year of purchase. This provision is scheduled to end in December 2026. If you’re a business owner considering significant equipment purchases, make sure you’re aware of this impending change and how it might affect your tax planning.

The Net Operating Loss (NOL) deduction rules are also changing. The TCJA limited NOL deductions to 80% of taxable income and eliminated the ability to carry losses back, while removing the 20-year limit on carrying losses forward. These changes are set to expire at the end of 2028, potentially reverting to pre-TCJA rules.

Another significant expiring provision is Section 163(j), which affects the deductibility of business interest. The TCJA imposed limitations on interest deductions by removing the add-back of depreciation, amortization, and depletion when calculating adjusted taxable income. This provision is scheduled to expire in December 2025, though there are ongoing discussions about potential extensions or modifications.

For high-net-worth individuals and family businesses, changes to estate and gift tax exemptions are noteworthy. The TCJA substantially increased these exemptions, but they are set to revert to lower levels in 2026. The 2025 estate tax exemption of $13.99 million per person will decrease to about $7 million (the original $5 million exemption adjusted for inflation).

As these TCJA provisions approach their expiration dates, it’s essential for businesses to plan ahead. You should work closely with tax professionals to develop strategies that account for these potential changes.

What Happens When Tax Cuts Expire in 2025?

The expiration of these tax cuts will have far-reaching implications for both businesses and individuals.

Let’s break down some of the key changes:

1. Individual Income Tax Rates

One of the most significant changes will be the adjustment of individual income tax rates. The TCJA implemented lower tax brackets across the board, which are scheduled to revert to pre-2018 levels.

We’ve provided a comparison of the current rates and what they’re set to become in 2026:

- Current rates (2024): 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

- Rates after 2025: 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

This change will affect virtually all taxpayers, with many seeing an increase in their federal income tax liability.

2. Standard Deduction

The TCJA nearly doubled the standard deduction, so it’s less likely for taxpayers to itemize deductions. After 2025, the standard deduction is set to revert to lower levels, adjusted for inflation. For example:

2024 standard deduction:

- Married filing jointly: $29,200

- Single: $14,600

Estimated 2026 standard deduction (pre-TCJA levels, adjusted for inflation):

- Married filing jointly: Approximately $16,600

- Single: Approximately $8,300

This reduction in the standard deduction could lead to more taxpayers choosing to itemize their deductions.

3. Child Tax Credit

The Child Tax Credit, which was expanded under the TCJA, is also set to revert to its pre-2018 levels. Currently, the credit is $2,000 per qualifying child under 17, with up to $1,700 of that amount refundable in 2024. After 2025, it’s scheduled to return to $1,000 per child with more limited refundability.

4. Pass-Through Business Income Deduction

The TCJA introduced a 20% deduction for qualified business income from pass-through entities such as sole proprietorships, partnerships, and S corporations. This deduction is set to expire after 2025 which will potentially increase the tax burden on many small business owners.

5. Corporate Tax Rate

While many of the individual tax provisions are temporary, the reduction in the corporate tax rate from 35% to 21% is permanent for C corporations. However, there have been discussions about potentially changing this rate, so businesses should stay informed about any potential changes.

6. Alternative Minimum Tax (AMT)

The TCJA significantly increased the AMT exemption amount and phase-out thresholds, effectively reducing the number of taxpayers subject to AMT. These higher thresholds are set to expire after 2025, potentially subjecting more taxpayers to AMT.

7. Estate Tax Exemption

The TCJA doubled the estate tax exemption, which stands at $13.61 million per individual for 2024. This increased exemption is set to expire after 2025, reverting to approximately half of its current level (adjusted for inflation).

Prepare for 2025 with Professional Tax Planning

Get personalized strategies to minimize your tax burden and maximize your financial opportunities.

Economic Impact of the Expiring Tax Cuts

The expiration of these tax cuts will likely have significant economic implications. According to the Congressional Budget Office (CBO), allowing these provisions to expire as scheduled would raise federal revenue by $1.4 trillion from 2026 to 2031. However, this increase in tax revenue could come at the cost of reduced economic growth.

Potential Scenarios and Future Outlook

In 2025, there are several potential scenarios that could play out:

- Full extension: Congress could choose to extend all or most of the expiring provisions, maintaining the current tax structure. However, this would have significant implications for the federal budget deficit.

- Partial extension: Some provisions might be extended while others are allowed to expire. This could involve extending certain middle-class tax benefits while allowing tax cuts for higher-income individuals to expire.

- New tax legislation: Congress might pass entirely new tax legislation that replaces or modifies the expiring provisions.

- No action: If Congress takes no action, all of the expiring provisions will sunset as scheduled.

The outcome will likely depend on the political and economic landscapes in 2025.

Preparing for the Changes

Given the uncertainty surrounding the future of these tax cuts, it’s crucial for businesses and individuals to start preparing now. Our team at Elder & Hanson Company, Ltd. has outlined some strategies to consider:

- Review your tax situation: Understand how the potential changes might affect your tax liability. This might involve projecting your income and deductions under different scenarios.

- Accelerate income: If you expect to be in a higher tax bracket after 2025, consider accelerating income into the years before the tax cuts expire.

- Defer deductions: Similarly, you might want to defer deductions to years when tax rates are potentially higher.

- Estate planning: If you have a large estate, consider taking advantage of the current high estate tax exemption before it potentially decreases.

- Business structure review: For business owners, review your business structure to ensure it’s optimal for the potential new tax environment.

- Stay informed: Stay on top of any new tax legislation or extensions that might be passed before the end of 2025.

Impact on Specific Groups

Different groups will be affected differently by the expiration of these tax cuts, for example:

- Small business owners: The expiration of the 20% deduction for qualified business income could significantly impact small business owners who operate as pass-through entities.

- Corporations: While the lower corporate tax rate is permanent, any changes to this rate would have a substantial impact on corporations’ tax liabilities and potentially their business decisions.

Long-Term Implications

The expiration of the TCJA provisions could have several long-term implications:

- Federal deficit: While allowing the tax cuts to expire would increase federal revenue, it could also slow economic growth, potentially offsetting some of the deficit reduction.

- Income inequality: Some argue that making the tax cuts permanent would exacerbate income inequality, as higher-income individuals and corporations have disproportionately benefited from the TCJA.

- Economic growth: The potential impact on economic growth is debated. While lower taxes can stimulate spending and investment, they can also lead to higher deficits, which some economists argue can hinder long-term growth.

- Tax code complexity: The expiration of these provisions could reintroduce complexity into the tax code that was simplified by the TCJA.

Navigate the 2025 Tax Changes with Elder Hanson & Company

The impending expiration of key provisions of the Tax Cuts and Jobs Act in 2025 presents both challenges and opportunities for businesses and individuals. At Elder Hanson & Company, Ltd., our Naperville, IL tax planning experts are committed to helping you navigate these changes and optimize your tax strategy. Our CPAs and strategic advisors are passionate about helping businesses like yours navigate this evolving landscape and ensuring you have updated information.

If you’re concerned about how the expiring tax cuts might affect your business, don’t hesitate to reach out to us. Our team of tax professionals in Naperville, IL, is here to provide personalized guidance and help you develop a tax strategy that aligns with your financial goals, both now and in the future.