This article will explore 10 key tax planning strategies you can utilize to keep more of your hard-earned money. Before we dive in, let’s take a quick look at the strategies:

| Strategy | Description | Benefit |

|---|---|---|

| Understand Your Tax Bracket | Determine your tax bracket and how it affects your taxable income. | Accurate tax planning and potential tax savings. |

| Maximize Contributions to Retirement Accounts | Contribute pre-tax dollars to traditional IRAs and 401(k)s. | Reduce taxable income and defer taxes on earnings. |

| Utilize Health Savings Accounts (HSAs) | Contribute pre-tax dollars to cover qualified medical expenses. | Triple tax benefit: tax-deductible contributions, tax-free growth, and tax-free qualified withdrawals. |

| Strategic Use of Itemized Deductions vs. Standard Deduction | Choose between a fixed standard deduction or itemize expenses if they exceed the standard deduction. | Reduce taxable income by claiming deductible expenses. |

| Explore Tax-Efficient Investments | Invest in assets with tax advantages like municipal bonds and long-term capital gains. | Reduce tax liability on investment income. |

| Take Advantage of Tax Credits | Claim tax credits like the EITC, Child Tax Credit, or Retirement Savings Credit. | Reduce tax bill with tax credits. |

| Consider Charitable Contributions | Donate to qualified charities and deduct contributions from taxable income. | Reduce tax bill and support worthy causes. |

| Plan for Capital Gains and Losses | Offset capital gains with capital losses or utilize tax-loss harvesting. | Minimize capital gains tax liability. |

| Bunch Itemized Deductions | Strategically group certain expenses (e.g., medical bills, charitable contributions) into alternating years to maximize the benefit of itemizing deductions if they fluctuate significantly year-to-year. | Ensure you itemize deductions in years where they exceed the standard deduction. |

| Contribute to Flexible Spending Accounts (FSAs) | Contribute pre-tax dollars for qualified medical and dependent care expenses. | Reduce taxable income and save on out-of-pocket expenses. |

| Consider Roth IRAs (If Eligible) | Contribute after-tax dollars to a Roth IRA for tax-free qualified withdrawals in retirement. | Potential for tax-free growth on contributions and avoid ordinary income taxes in retirement (depending on income level and withdrawal rules). |

Strategy 1. Understanding Your Tax Bracket: The First Step to Tax Planning

Knowing your tax bracket is crucial for effective tax planning. The U.S. has a progressive income tax system, meaning higher incomes are taxed at higher rates. There are seven federal income tax brackets ranging from 10% to 37% in 2024.

However, just because you earn enough to fall into a specific tax bracket doesn’t mean your entire income is taxed at that rate. Here’s how it works:

- Taxable income: This is the amount of your income subject to tax. It’s calculated by subtracting deductions from your total income.

- Tax brackets: Your taxable income is divided into “chunks”, and each chunk is taxed at its corresponding rate. For example, if you’re in the 12% tax bracket, only the portion of your income that falls within that bracket is taxed at 12%.

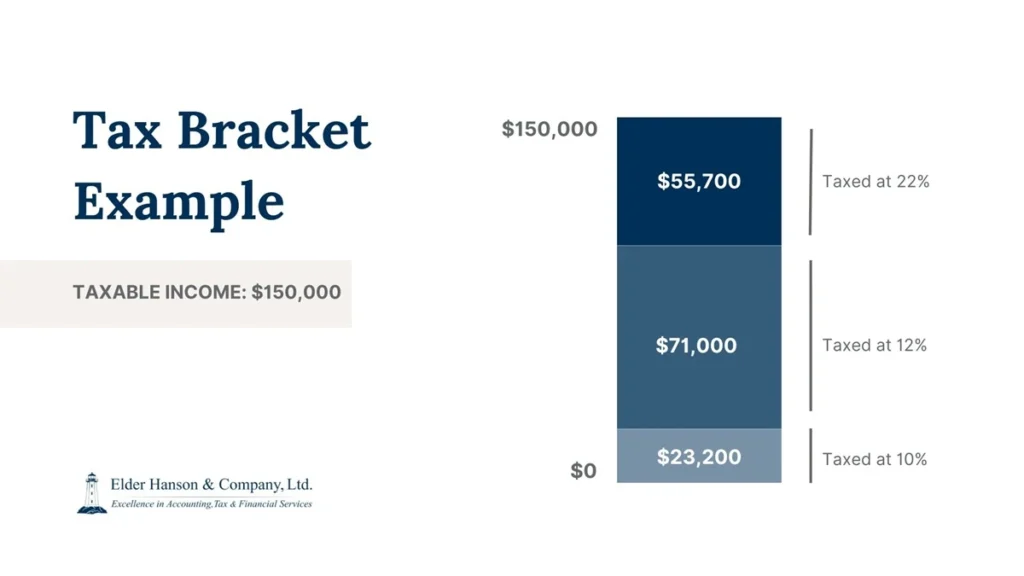

Example: Let’s say you’re a married couple filing jointly with a taxable income of $150,000 in 2024. This places you in the 22% tax bracket. However, not all of your income is taxed at 22%.

- The first $23,200 is taxed at 10%.

- The next $71,100 (from $23,201 to $94,300) is taxed at 12%.

- The remaining 55,700(from $94,301 to $150,000) is taxed at 22%.

As you can see, the tax brackets are applied progressively, and only the portion of your income within each bracket is subject to that specific tax rate.

Strategy 2. Maximize Contributions to Retirement Accounts

One of the most effective ways to reduce your taxable income is by contributing to tax-advantaged retirement accounts. Traditional IRAs and 401(k)s allow you to deduct your contributions from your current taxable income which lowers your immediate tax bill. The funds then grow on a tax-deferred basis, meaning you won’t pay taxes on any earnings until you withdraw them in retirement. This can be particularly beneficial for high-income earners who fall into higher tax brackets.

Example: John, a Naperville resident, is over age 50, single, and has earned income of $75,000 and falls into the 22% marginal federal income tax bracket in 2024. He contributes $ 7,000 to his traditional IRA, potentially saving him $1,760 in federal income taxes.

Strategy 3. Utilize Health Savings Accounts (HSAs)

If you have a high-deductible health plan (HDHP), you may be eligible to contribute to a Health Savings Account (HSA). HSAs allow you to contribute money to a designated account to cover qualified medical expenses. Contributions are tax-deductible, any earnings on the account grow tax-free, and qualified withdrawals used for medical expenses are also tax-free. In other words, there is a triple tax benefit for those who qualify.

Strategy 4. Strategic Use of Itemized Deductions vs. Standard Deduction

The standard deduction is a fixed dollar amount that the IRS allows you to subtract from your adjusted gross income (AGI) to reduce your taxable income. However, if your total itemized deductions exceed the standard deduction, you can claim them instead. Itemized deductions include expenses like mortgage interest, state and local taxes (SALT) paid (limited deduction applies), charitable contributions, and medical and dental expenses exceeding 7.5% of your AGI. It’s important to track your expenses throughout the year to determine if itemizing will be beneficial.

Example: Sarah, a homeowner in Naperville, pays $10,000 in mortgage interest and $8,000 in state and local taxes, thus her total allowable itemized deductions are $18,000. The standard deduction for her single filing status in 2024 is $14,600. Since her itemized deductions of $18,000 exceed the standard deduction of $14,600, she would benefit from itemizing on her tax return.

Strategy 5. Explore Tax-Efficient Investments

Investing in tax-efficient assets can significantly reduce your tax liability. Consider investments like municipal bonds, which typically generate interest exempt from federal income tax and may also be exempt from state and local taxes depending on your location. Focus on long-term capital gains, which are taxed at lower rates than ordinary income tax rates. If you’re not sure how to move forward, it’s best to consult a financial advisor to discuss tax-efficient investment strategies suitable for your individual financial goals and risk tolerance.

Don't Let Taxes Take Away Your Hard-Earned Money

Let our Naperville income tax planning services keep more of your money. Schedule a consultation now.

Strategy 6. Take Advantage of Tax Credits

Tax credits are dollar-for-dollar reductions in your tax bill. Some common tax credits include the Earned Income Tax Credit (EITC) for low- and moderate-income earners, the Child Tax Credit for qualifying children, and the Retirement Savings Credit for contributions to IRAs. Be sure to research all available tax credits to see if you qualify.

Strategy 7. Consider Charitable Contributions

Donating to qualified charities allows you to deduct your contributions from your taxable income, which can potentially reduce your tax bill. You can claim deductions for cash donations, as well as donations of qualified property like clothing or household goods. Documentation for charitable contributions is important, so make sure to keep any receipts or paper trails.

Strategy 8. Plan for Capital Gains and Losses

When you sell investments like stocks or bonds, you may incur capital gains or losses. Capital gains taxes are levied on profits from the sale of capital assets. Offsetting capital gains with capital losses can minimize your capital gains tax liability. You can also consider “tax-loss harvesting”, which involves selling investments at a loss to offset capital gains and reduce your overall tax burden.

Strategy 9. Bunch Itemized Deductions

This strategy involves strategically grouping certain expenses that fluctuate significantly from year to year, such as medical bills or charitable contributions, into alternating years. This allows you to maximize the benefit of itemizing deductions in years where your total expenses exceed the standard deduction.

For example, if you have a high medical expense year, you may want to itemize deductions in that year and claim the standard deduction in the following year when your medical expenses are lower.

Strategy 10. Contribute to Flexible Spending Accounts (FSAs)

Similar to HSAs, Flexible Spending Accounts allow you to contribute pre-tax dollars to cover qualified medical and dependent care expenses. These contributions reduce your taxable income and can help you save money on out-of-pocket medical costs. However, unlike HSAs, any unused funds in an FSA at the end of the year may be forfeited, depending on your employer’s plan.

Unlock Your Tax Savings Potential

There are countless strategies that can make a significant difference in how much you save. By incorporating these strategies into your financial plan, you can potentially lower your tax bill and achieve your long-term financial goals. Understanding tax laws can be complex, so consulting with local tax professionals like Elder Hanson & Company, Ltd. is important to ensure you’re maximizing your tax benefits and adhering to all current regulations. Our team is passionate about helping you unlock your savings potential! Contact us today to start your journey towards a brighter financial future.

FAQ

What is an important tax planning strategy for self-employed individuals?

Maximize deductions. Self-employed individuals can deduct many business expenses and make retirement plan contributions, reducing taxable income.

How do high-income earners reduce taxes?

High-income earners often use tax-advantaged investments, contributions to retirement accounts, or tax-loss harvesting to offset taxable income.

How to save money on taxes as a single person?

Understand tax brackets to optimize income, contribute to retirement accounts, and take advantage of tax deductions (like student loan interest or charitable donations).