As a business owner in Illinois, you’ve made the smart choice to structure your company as an LLC. But now you’re facing a labyrinth of tax forms, deadlines, and regulations that seem designed to confuse even the savviest entrepreneur. Take a deep breath — you’re not alone in this journey. Single-member startups or multi-million dollar operations, our Naperville income tax preparers and strategic advisors are here to simplify the process for you.

Understanding Illinois LLC Pass-Through Taxation

Limited Liability Companies (LLCs) in Illinois typically benefit from pass-through taxation. This means the LLC itself doesn’t pay taxes on its profits. Instead, the income “passes through” to the members, who report their share of the LLC’s financial activity on their personal tax returns.

Key benefits of pass-through taxation include:

- Avoiding double taxation

- Potential for lower overall tax rates

- Simplified tax filing process

How Are LLCs Taxed in Illinois?

The taxation of your Illinois LLC depends on its structure and any elections you’ve made with the Internal Revenue Service (IRS). Here’s a breakdown of the common scenarios:

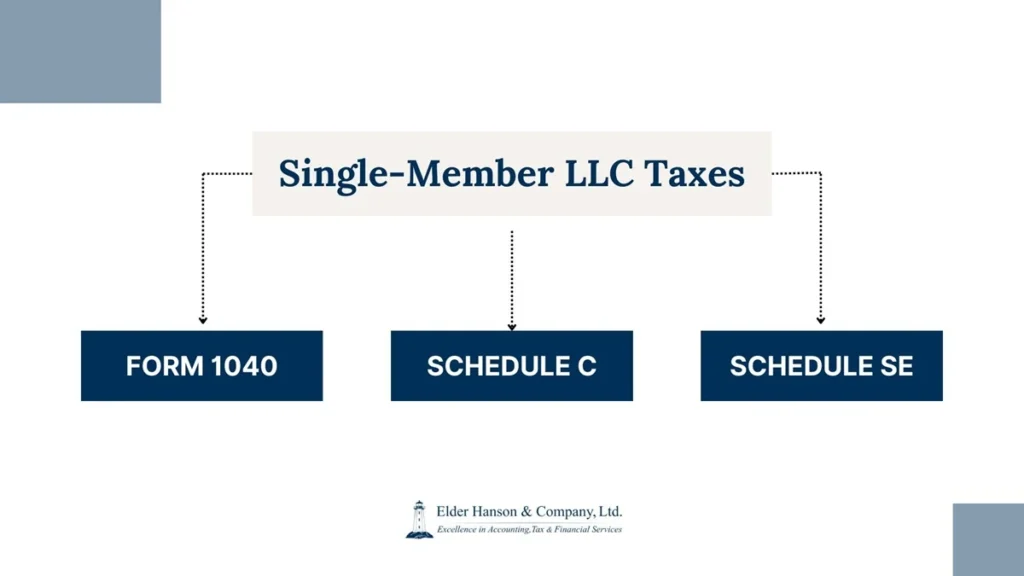

1. Single-Member LLC

By default, a single-member LLC is treated as a disregarded entity for tax purposes. This means:

- The LLC doesn’t file a separate federal tax return.

- The owner reports business income and expenses on Schedule C of their personal Form 1040.

- The owner pays self-employment tax on the LLC’s net income.

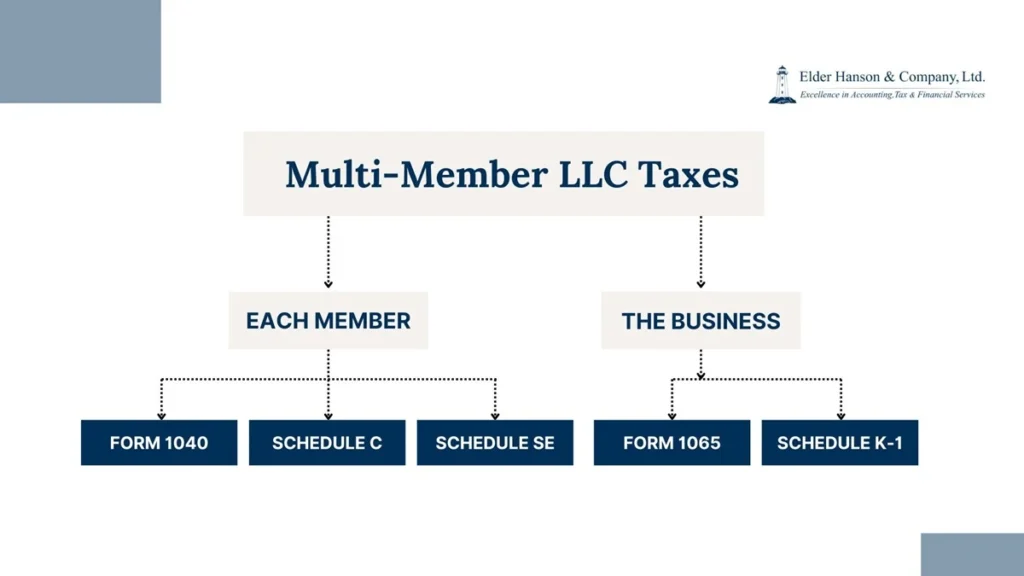

2. Multi-Member LLC

Multi-member LLCs are typically taxed as partnerships by default. In this case:

- The LLC must file Form 1065 (U.S. Return of Partnership Income).

- Each member receives a Schedule K-1 showing their share of the LLC’s income.

- Members report their share of income on their personal tax returns.

3. LLC Taxed as an S Corporation

LLCs can elect to be taxed as S corporations by filing Form 2553 with the IRS. This can offer tax savings for some businesses by reducing self-employment taxes. Under this structure:

- The LLC files Form 1120-S.

- Members pay self-employment tax only on their salary, not on distributions.

- Members still report their share of income on personal tax returns.

4. LLC Taxed as a C Corporation

LLCs can also elect to be taxed as C corporations by filing Form 8832. This is less common but may offer benefits for larger businesses through healthcare fringe benefits and the ability to retain earnings at corporate tax rates.

Get Professional Help with LLC Tax Filing

Navigating Illinois LLC tax laws can be complex. Our tax professionals provide your business with tailored solutions

to result in accurate and timely filings.

5. Husband and Wife LLC

In Illinois, married couples who jointly own and operate an LLC cannot file as a Qualified Joint Venture. They must either:

- File as a partnership (multi-member LLC)

- Elect to be taxed as an S corporation

This is because Illinois isn’t a community property state, which affects how husband and wife LLCs are treated for tax purposes.

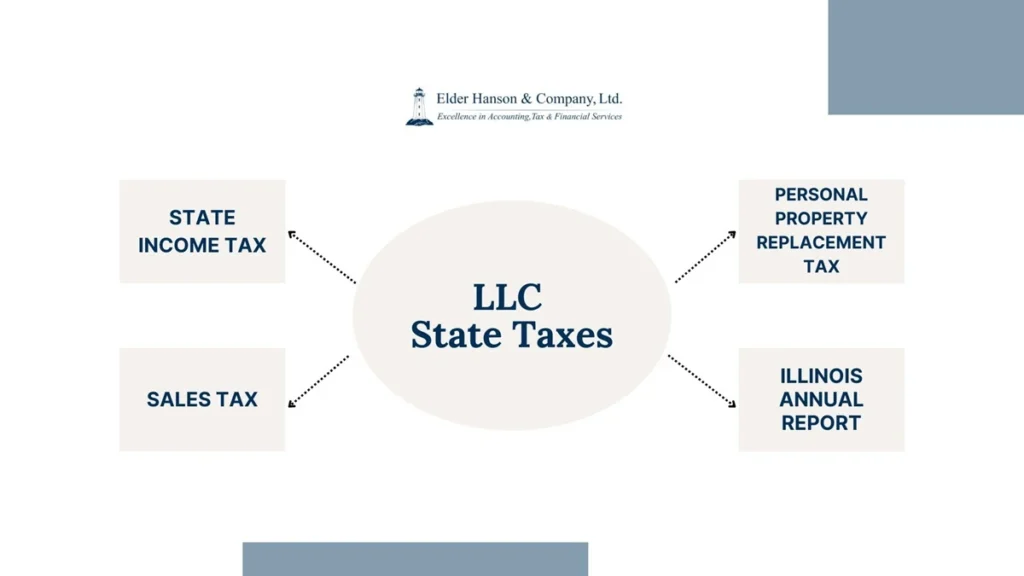

Illinois State Taxes for LLCs

In addition to federal taxes, your LLC pays various state taxes to the Illinois Department of Revenue and Illinois Secretary of State as listed below are rates for 2025:

- Illinois State Income Tax: Illinois has a flat income tax rate of 4.95% for both individuals. LLC members will pay this rate on their share of the LLC’s profits for sole proprietors as well as from pass-through entities such as partnerships and S corporations. C corporations pay a 7.0% Illinois income tax. The Illinois PPRT, as explained below, is in addition to the Illinois state income tax.

- Illinois Sales Tax: If your LLC sells goods, you’ll need to collect and remit Illinois sales tax. The Illinois base state sales tax rate is 6.25%, but local jurisdictions may add their own sales taxes, potentially bringing the total to 11% in some areas.

- Personal Property Replacement Tax (PPRT): Illinois LLCs are subject to the PPRT, which is 1.5% of net income for partnerships and S corporations and 2.5% of net income for C corporations. The Illinois state income tax, as explained above, is in addition to the Illinois PPRT.

- Illinois Annual Report: The Illinois LLC annual report filing fee is $75.

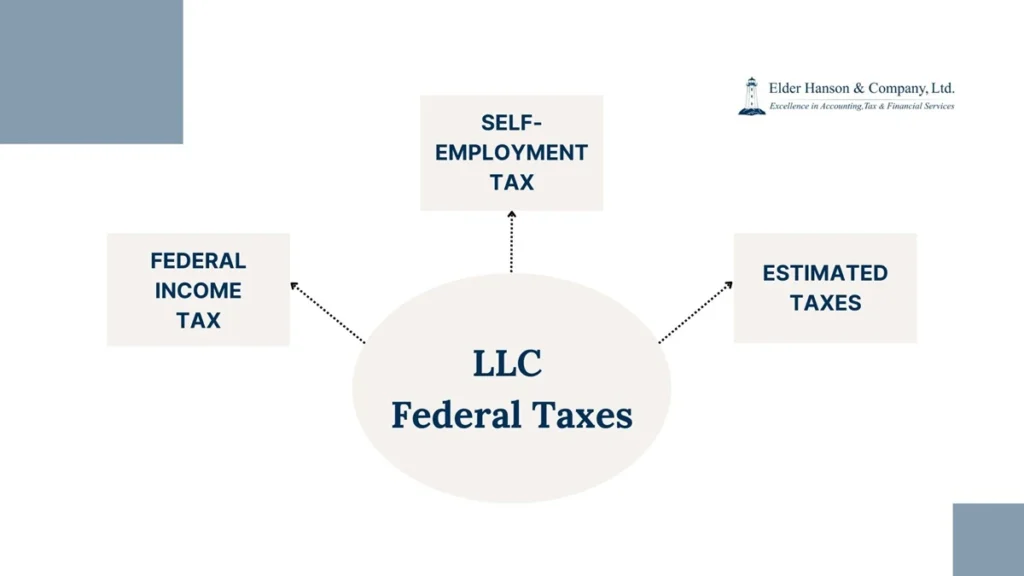

Federal Taxes for LLCs

Your Illinois LLC will also have federal tax obligations:

- Federal Income Tax: The federal income tax rate for LLC members depends on the tax entity selection type for federal tax purposes. Single-member LLCs tax as a sole proprietor and multi-member LLCs that are tax as S corporations or partnerships report their share of LLC income on their personal returns. Meanwhile, LLCs tax as C corporations pay federal income tax at the business entity level and members pay tax on their dividends.

- Self-Employment Tax: Single member LLCs that are taxed as a sole proprietor on their personal income tax return must pay self-employment tax (15.3% for 2025) on their share of LLC profits. This covers Social Security and Medicare contributions.

- Estimated Taxes: If you expect to owe $1,000 or more in federal income taxes on your personal income tax return, you’ll need to make quarterly estimated tax payments.

Illinois LLC Tax Filing Deadlines

To avoid penalties, mark these important income tax filing due dates on your calendar:

| Deadline | Tax Form | Description |

|---|---|---|

| March 15 | Form 1065 or 1120S | Federal S Corp or Partnership Return |

| March 15 | Form IL-1120S | Illinois S Corp Return |

| April 15 | Form IL-1065 | Illinois Partnership Return |

| April 15 | Form 1040 | Federal Personal Income Tax Return |

| April 15 | IL-1040 | Illinois Personal Income Tax Return |

| April 15 | Form 1120 | Federal C Corp Income Tax Return |

| April 15 | Form IL-1120 | Illinois C Corp Income Tax Return |

Filing Business Taxes for LLC in Illinois Efficiently

To optimize your LLC’s tax position:

- Choose the right tax classification for your business

- Keep detailed records of all income and expenses

- Take advantage of all available deductions and credits

- Consider the timing of income and expenses

- Plan for estimated tax payments

- Consult with a tax professional regularly

Tax Deductions and Credits for Illinois LLCs

Common deductions for Illinois LLCs include:

- Business expenses (rent, utilities, supplies)

- Employee salaries and benefits

- Travel and vehicle expenses

- Advertising and marketing costs

- Professional fees

Illinois also offers several tax credits that your LLC may be eligible for, such as:

Simplify Your Illinois LLC Taxes with Elder Hanson & Company

Navigating Illinois LLC taxes requires attention to detail and an understanding of both state and federal requirements. From choosing the right tax classification to meeting filing deadlines and maximizing deductions, there’s a lot to consider. Thankfully, you don’t have to go through this alone.

At Elder Hanson & Company, Ltd., our Naperville income tax preparation services are designed to take the stress out of tax season for LLC owners. Contact us today to schedule a consultation and let us help your business navigate Illinois LLC taxes with confidence.

FAQ

What creates income tax nexus in Illinois for LLCs?

The income tax nexus in Illinois for an LLC generally occurs when the LLC has a substantial presence or connection to the state. This can include having employees, owning property, or engaging in significant business activity within Illinois. If an LLC has nexus, it’s typically required to file and pay Illinois income tax on its profits generated within the state.

Can you file your LLC taxes separately from your personal taxes?

Yes, you can file your LLC taxes separately from your personal taxes. This is especially common if your LLC is taxed as a C corporation, which means it is treated as a separate legal entity. Keep in mind that a LLC taxed as a C corporation is only recommended in certain situations. If your LLC is taxed as a sole proprietorship, S corporation or partnership, its net income is reported on your personal tax return.