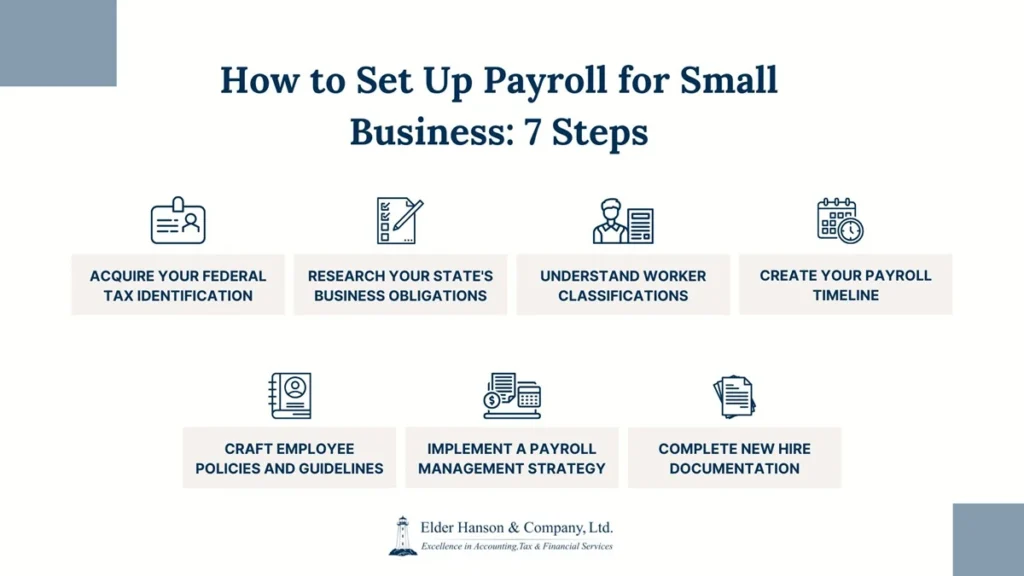

As a small business owner, establishing a payroll system is a crucial step in your company’s growth. While it may seem daunting at first, breaking down the process into manageable steps can make it much less overwhelming.

Please note that it is important to determine the proper business entity type and how that entity will be taxed for income tax purposes prior to the establishment of setting up payroll for your business. This guide does not go over the factors involved in selecting a business entity type or income tax entity type, but feel free to reach out to us as we are happy to discuss these items with you.

Our Naperville, IL, CPAs and strategic advisors at Elder Hanson & Company, Ltd. provide business establishment guidance and payroll support guidance, and we are here to guide you through the intricacies of setting up payroll for your small business.

Step 1: Obtain a Federal Employer Identification Number

The first step in setting up payroll for your small business is to acquire a Federal Employer Identification Number (EIN). This unique identifier is issued by the Internal Revenue Service (IRS) and is essential for tax reporting purposes.

How to Get an EIN

- Visit the IRS website

- Complete the online application

- Receive your EIN instantly

Pro Tip: Keep your EIN in a secure location, as you’ll need it for various business filings and tax-related matters.

Why Is an EIN Important?

- It’s required for filing federal tax returns.

- You’ll need it to open a business bank account.

- It’s necessary for hiring employees and processing payroll.

- Many vendors and clients may request it for tax purposes.

Step 2: Research State-Specific Business Requirements

After securing your federal EIN, it’s crucial to understand your state’s specific business requirements. These may include obtaining a state tax ID number and registering for state-level taxes.

Key State-Level Considerations

- State income tax registration (if applicable)

- State unemployment insurance account

- Workers’ compensation insurance

- State disability insurance (in some states)

Remember, requirements can vary significantly from state to state, so be sure to research thoroughly or consult with a professional.

Common State-Specific Requirements

- State tax ID: Similar to your federal EIN, but for state tax purposes.

- Unemployment insurance: Most states require businesses to pay unemployment insurance taxes.

- Workers’ compensation: Many states mandate this insurance to cover work-related injuries or illnesses.

- New hire reporting: States require businesses to report new hires within a specified timeframe.

- Disability insurance: Some states (like California, New York, and New Jersey) require employers to provide short-term disability insurance.

Step 3: Differentiate Between Employees and Independent Contractors

Properly classifying your workers is crucial for tax purposes and compliance with labor laws. The distinction between employees and independent contractors impacts how you handle payroll taxes and benefits.

Key Factors in Classification

- Level of control over work performed

- Financial aspects of the working relationship

- Nature of the business relationship

If you’re unsure about worker classification, the IRS provides guidelines to help you make the correct determination.

Implications of Misclassification

- Tax penalties and back taxes

- Legal issues and potential lawsuits

- Requirement to provide benefits retroactively

- Damage to your business reputation

Employee vs. Independent Contractor: Key Differences

You need to decide whether the people you hire are independent contractors or employees. This decision affects how you report income and withhold taxes. Listed below are some, but not all of the factors that help determine if the worker would be considered an employee vs. independent contractor.

| Aspect | Employee | Independent Contractor |

|---|---|---|

| Control | Employer controls how work is done | Contractor controls how work is done |

| Tools | Typically provided by employer | Typically provided by contractor |

| Payment | Regular wages, salary | Paid per project or task |

| Tax Withholding | Employer withholds taxes | Contractor responsible for own taxes |

| Benefits | Often eligible for benefits | Not eligible for company benefits |

| Work Hours | Set by employer | Set by contractor |

Step 4: Establish a Payroll Schedule

Choosing the right payroll schedule is essential for maintaining consistent cash flow and meeting your employees’ expectations.

Common payroll frequencies include:

- Weekly

- Bi-weekly (every two weeks)

- Semi-monthly (twice a month)

- Monthly

When selecting a payroll schedule, consider:

- State laws regarding minimum pay frequency

- Your business’s cash flow

- Industry standards

- Employee preferences

Pro Tip: Many small businesses find bi-weekly payroll to be a good balance between administrative effort and employee satisfaction.

Comparing Payroll Schedules

Weekly (52 payrolls per year):

- Pros: Consistent for hourly workers, preferred by many employees.

- Cons: More frequent processing, higher administrative costs.

Bi-weekly (26 payrolls per year):

- Pros: Consistent schedule, aligns well with many benefit deductions.

- Cons: Two months with three payrolls, which can affect budgeting.

Semi-monthly (24 payrolls per year):

- Pros: Easier budgeting, aligns with many accounting periods.

- Cons: Can be challenging for hourly employees, may require mid-period cutoffs.

Monthly (12 payrolls per year):

- Pros: Least administrative work, lowest processing costs.

- Cons: Less popular with employees, may not comply with some state laws.

Need Ongoing Support with Your Small Business Payroll?

Our Naperville, IL CPAs and strategic advisors are here to help.

Step 5: Develop an Employee Handbook and Time-Off Policies

Creating a comprehensive employee handbook is crucial for setting clear expectations and ensuring consistent treatment of all employees.

Your handbook should include:

- Company policies and procedures

- Employee rights and responsibilities

- Time-off and leave policies

- Overtime rules

- Code of conduct

- Anti-discrimination and harassment policies

- Confidentiality and data protection guidelines

- Social media and technology use policies

- Performance review processes

- Disciplinary procedures

When developing your time-off policies, consider:

- Paid time off (PTO) structure

- Sick leave

- Vacation time

- Personal days

- Holidays

- Bereavement leave

- Jury duty

- Military leave

- Family and Medical Leave Act (FMLA) compliance

Remember to stay compliant with federal and state laws regarding mandatory leave and overtime regulations.

Tips for Creating an Effective Employee Handbook

- Use clear, simple language.

- Include an acknowledgment form for employees to sign.

- Review and update the handbook regularly.

- Consult with a legal professional to ensure compliance.

- Make the handbook easily accessible to all employees.

Step 6: Select a Payroll System and Designate a Payroll Manager

Choosing the right payroll system is one of the most important factors in efficiently managing your small business payroll.

You have several options:

- Manual payroll processing

- Payroll software

- Full-service payroll provider

Factors to Consider When Choosing a Payroll System

- Number of employees

- Budget

- Desired level of automation

- Need for additional features (e.g., time tracking, tax filing)

- Integration with existing accounting software

- Mobile accessibility

- Customer support quality

- Scalability as your business grows

Popular Payroll Software Options

- QuickBooks Payroll

- Gusto

- ADP Run

- Paychex Flex

- Square Payroll

- Zenefits

- OnPay

After selecting a system, decide who will manage your payroll process:

- Yourself (if you have the time and expertise)

- An in-house bookkeeper or accountant

- An outsourced payroll service provider

Comparing Payroll Management Options

DIY payroll:

- Pros: Cost-effective, full control over the process.

- Cons: Time-consuming, higher risk of errors, requires in-depth knowledge.

In-house payroll staff:

- Pros: Dedicated resource, familiar with company policies.

- Cons: Ongoing salary and training costs, potential for turnover.

Outsourced payroll service:

- Pros: Expertise, time-saving, reduced liability.

- Cons: Higher costs, less direct control, potential communication challenges.

Step 7: Ensure Proper Documentation for New Hires

When bringing on new employees or contractors, it’s essential to have them complete the necessary paperwork for tax and legal purposes.

Required forms for employees:

- Form W-4 (Employee’s Withholding Certificate).

- Form I-9 (Employment Eligibility Verification).

- State Withholding Certificate (if required by the state, Employee state income tax withholdings).

- Direct Deposit Authorization (if direct deposit of the Employee’s net paycheck is offered).

Additional Steps for New Hires

- Verify the employee’s Social Security number.

- File a new hire report with your state (typically within 20 days of hiring).

- Set up direct deposit (if offered).

- Collect emergency contact information.

- Provide information about benefits and enrollment procedures.

- Issue company property (e.g., keys, ID badges, equipment).

- Schedule orientation and training sessions.

Pro Tip: Create a new hire checklist to ensure you don’t miss any critical steps in the onboarding process.

For independent contractors:

- Form W-9 (Request for Taxpayer Identification Number and Certification).

Essential Components of a New Hire Packet

- Offer letter and employment contract

- Job description

- Employee handbook acknowledgment form

- Direct deposit authorization form

- Benefits enrollment forms

- Non-disclosure or confidentiality agreement (if applicable)

- Emergency contact information form

- Company organizational chart

- First-day instructions (parking, dress code, etc.)

- Required tax forms (W-4, I-9, state withholding forms)

Running Your Small Business Payroll

Once you’ve completed these seven steps, you’re ready to start processing payroll for your small business.

We’ve provided a quick overview of the typical payroll process:

- Collect time and attendance data

- Calculate gross pay

- Determine deductions (taxes, benefits, etc.)

- Process payments (direct deposit or checks)

- Maintain accurate payroll records

- File and pay payroll taxes (federal, state, and local)

- Prepare and distribute year-end tax forms (W-2s and 1099s)

Many of these steps can be simplified through payroll automation. Remember, staying compliant with tax laws and regulations is crucial. Be sure to keep accurate records and stay up-to-date with any changes in payroll-related legislation.

Best Practices for Ongoing Payroll Management

- Keep detailed records of all payroll transactions.

- Regularly reconcile payroll accounts.

- Stay informed about changes in tax laws and regulations.

- Conduct periodic audits of your payroll process.

- Provide clear and timely communication to employees about payroll matters.

- Implement strong security measures to protect sensitive payroll data.

- Consider outsourcing complex tasks like tax filing to reduce errors.

- Continuously evaluate and improve your payroll process.

Streamline Your Payroll Process with Elder Hanson & Company, Ltd.

Setting up payroll for your small business may seem like a complex task, but by following these seven steps, you can create a solid foundation for managing your employees’ compensation efficiently and compliantly. Payroll shouldn’t be part of your stressors.

If you need guidance with any aspect of setting up or managing your small business payroll, don’t hesitate to reach out to our team of highly skilled Naperville, IL CPAs and strategic advisors. We’re here to help you focus on growing your business while we take care of the accounting and tax details.

Contact us today — from initial setup based on your company’s designated policies to ongoing assistance and troubleshooting, we will provide the support and expertise you need to ensure your payroll runs smoothly and efficiently.