As a business owner in Naperville or the surrounding area, you’re constantly juggling multiple responsibilities. From managing employees to making strategic decisions, your plate is always full. At Elder Hanson & Company, Ltd., our CPAs understand the challenges you face, especially when it comes to managing your financial records. That’s why we’re here to shed light on the numerous benefits of outsourcing bookkeeping services and how they can revolutionize your business operations.

How Does Outsourced Bookkeeping Work?

Before we dive into the benefits of working with outsourced accounting firms, let’s clarify what outsourcing bookkeeping entails. Essentially, it means delegating your bookkeeping tasks to a professional third-party service provider instead of handling them in-house. This approach allows you to tap into specialized expertise without the overhead of a full-time employee.

For industries such as insurance, counseling, and consulting, where client interactions and specialized knowledge are paramount, outsourcing bookkeeping can be particularly beneficial. It allows you to focus on your core competencies while ensuring your financial records are managed with precision.

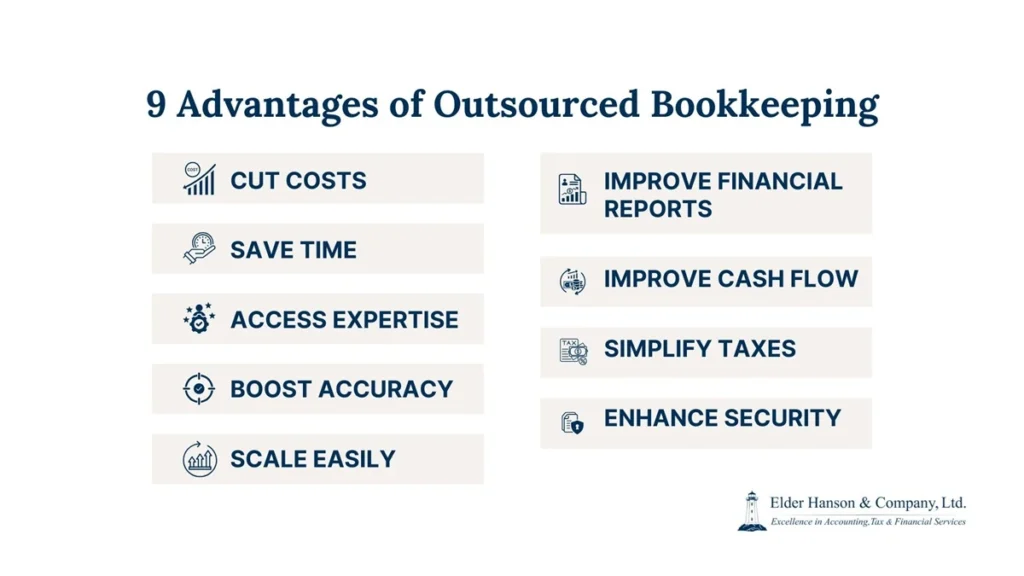

Now, let’s explore the nine key benefits of outsourcing bookkeeping that can transform your business operations.

1. Significant Cost Savings and Resource Optimization

One of the main advantages of outsourcing bookkeeping services is the potential for substantial cost savings. When you outsource, you eliminate the need for a full-time in-house bookkeeper, helping you save on:

- Salaries and benefits

- Training costs

- Office space and equipment

- Software licenses

By outsourcing, you convert fixed costs into variable expenses, allowing you to allocate resources more efficiently. This flexibility is especially valuable for small business owners who need to maintain tight control over their budgets.

Moreover, the money saved can be reinvested into core business activities that directly contribute to growth. Whether it’s improving your products, enhancing customer service, or expanding your marketing efforts, the cost savings from outsourcing bookkeeping can fuel your business’s advancement.

2. Time Efficiency and Focus on Core Business Activities

Time is a precious commodity for any business owner. Outsourcing bookkeeping frees up a significant amount of your time and allows you to focus on what you do best — running and growing your business.

Instead of spending hours reconciling accounts, tracking expenses, and managing financial transactions, you can dedicate that time to:

- Developing new business strategies

- Improving customer relationships

- Exploring new market opportunities

- Enhancing your products or services

By delegating bookkeeping tasks to experts, you not only save time but also ensure that your financial records are managed efficiently and accurately.

3. Access to Cutting-Edge Technology and Expertise

Outsourced bookkeeping services often come with access to state-of-the-art accounting software and technologies. These tools can provide real-time insights into your financial status, automate routine tasks, and improve overall accuracy.

Plus, when you partner with a professional bookkeeping firm like Elder Hanson & Company, Ltd., you’ll get access to a team of experts. Our professionals stay up-to-date with the latest accounting standards, tax regulations, and best practices to keep your books compliant and optimized for your business’s success.

4. Enhanced Accuracy and Reduced Errors

Business owners know that accuracy is crucial when it comes to financial records. Even small errors can lead to significant issues down the line. Outsourcing accounting services to professionals significantly reduces the risk of errors.

Experienced bookkeepers have systems in place to double-check entries, reconcile accounts regularly, and catch discrepancies early. This level of accuracy not only gives you peace of mind but also provides a solid foundation for making informed business decisions.

5. Scalability to Match Your Business Growth

As your business grows, your bookkeeping needs will evolve. One of the key benefits of outsourcing bookkeeping and accounting is the scalability it offers. Professional bookkeeping services can easily adapt to your changing needs, whether you’re experiencing rapid growth or seasonal fluctuations.

This scalability ensures that you always have the right level of support without the need to hire additional staff or invest in new systems. As your transaction volume increases or your financial processes become more complex, your outsourced bookkeeping service can seamlessly scale to meet these new demands.

6. Improved Financial Reporting and Insights

Outsourced bookkeeping services don’t just handle day-to-day transactions; they also provide valuable financial reports and insights.

These reports can include:

- Profit and loss statements

- Balance sheets

- Cash flow forecasts

- Budget vs. actual comparisons

With these insights at your fingertips, you’re better equipped to make informed decisions about your business’s future. Whether you’re considering expanding into new markets, investing in new equipment, or adjusting your pricing strategy, having accurate and up-to-date financial data is crucial.

7. Better Cash Flow Management

Effective cash flow management is vital for the survival and growth of any business. Outsourced bookkeeping services can significantly improve your cash flow management by:

- Providing regular cash flow forecasts.

- Supplying details of primary sources of revenue.

- Dispensing financial information to give insights on important business expenses.

A clear picture of your cash position at all times helps you make better decisions about spending, investments, and growth strategies.

8. Streamlined Tax Preparation and Compliance

Tax season can be a stressful time for business owners, but it doesn’t have to be. When you outsource your bookkeeping, you’re setting yourself up for a smoother tax preparation process.

Throughout the year, your outsourced bookkeeping team will ensure that:

- All transactions are properly categorized.

- Necessary documentation is organized and readily available.

- Financial statements are prepared in accordance with relevant standards.

This ongoing preparation means that when tax season arrives, you’re not scrambling to gather information or rectify errors. Instead, you have a clear, accurate financial picture ready for tax filing. This reduces both stress and the risk of costly mistakes or missed deductions.

9. Increased Data Security and Confidentiality

In today’s digital age, data security is more important than ever. Professional bookkeeping services invest heavily in robust security measures to protect your financial data. This includes:

- Secure, encrypted cloud storage

- Strict access controls

- Compliance with data protection regulations

By outsourcing your bookkeeping, you benefit from these advanced security measures, which might be costly or complex to implement on your own. This enhanced security not only protects your business but also gives you peace of mind knowing that your sensitive financial information is in safe hands.

Ready to Transform Your Business's Financial Operations?

Let us show you how outsourcing your bookkeeping can be the key to unlocking your Naperville area business’s true potential.

What to Look for When You’re Outsourcing Bookkeeping

While the benefits of outsourcing bookkeeping are clear, be sure to choose the right partner for your business. Here are key factors to consider:

1. Evaluate the Expertise of the Bookkeeping Company

Conduct thorough research on potential outsourcing firms. Look for:

- Years of experience in your industry

- Qualifications of their staff (e.g., Certified Public Accountants and QuickBooks Certified ProAdvisors)

- Client testimonials and case studies

- Range of services offered

2. Ensure Transparency in Communication

Choose a firm that values open and regular communication. They should:

- Provide clear, regular updates on your financial status.

- Be responsive to your questions and concerns.

- Offer multiple channels of communication (phone, email, video calls).

3. Verify Compliance with Security Standards

Data security is paramount. Ensure your chosen firm:

- Uses robust encryption for data storage and transfer.

- Complies with relevant data protection regulations.

- Has a clear policy for handling sensitive information.

Carefully consider these factors so you can find a bookkeeping partner that not only meets your current needs but can also support your business as it grows.

Embrace the Power of Outsourced Bookkeeping

The benefits of outsourcing bookkeeping are clear and impactful. From cost savings and improved accuracy to enhanced financial insights and streamlined tax preparation, outsourcing your bookkeeping can transform your business operations. As Naperville’s trusted CPAs, Elder Hanson & Company, Ltd. is here to help you harness these benefits.

Contact us today — our team of expert bookkeepers will take the burden of financial management off your shoulders, allowing you to focus on what you do best — growing your business.

FAQ

How much does it cost to outsource bookkeeping?

The cost of outsourcing bookkeeping can vary widely depending on several factors, including:

- Business size and complexity

- Scope of services

- Bookkeeper’s experience and qualifications

- Location

How do I review outsourced bookkeeping work?

Here are some tips for reviewing outsourced bookkeeping work:

- Regularly check your financial statements

- Compare your bookkeeping records to your bank statements

- Ask for explanations

- Review your tax returns